do pastors pay taxes in canada

On balance I have for a long time advocated for an only salary position and letting the Pastor do his or her own taxes. Visit PayScale to research pastor salaries by city experience skill employer and more.

Celebrating Youth Pastors On National Pastor Appreciation Day Ym360

In Victoria they dont.

. Answer 1 of 81. What Taxes Do Farmers Pay. Almost 2 billion of their farming income is tax-deductible by the federal.

Churches Can Withhold Income Taxes For. Clergy Residence Deduction. The average salary for a Pastor in Canada is C51200.

Do pastors pay federal income tax. If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a taxable benefit and included in his T4 return. Clergy are often housed by their congregations.

Canadian churches and religious organizations are also exempt from paying federal taxes under the Income Tax Act due to no taxable classes for churches says Bell. You can be reimbursed for deductions job tax and water charges under the state statutory depreciation system. If a church withholds FICA taxes for a pastor they are breaking the law.

Although the clergy residence deduction and the utilities share of the benefit can be excluded from income for the purpose of calculating tax deductions and CPP you still have to report it on your employees T4 slipSpecial rules apply if you pay for utilities or provide them for a. If the status were changed how much those churches would have to pay is unclear. And in fact religious organisations do pay tax where appropriate.

Ministers are not exempt from paying federal income taxes. Since the ministers employer is the church income tax from ministry income is exempt. On your T4 slip if you receive a housing allowance you can find your receipt.

Like any other taxpayer if you work for a religious order or parish member or serve as a regular minister in a religion or religious denomination you report your earnings when reporting them to the IRS. What Tax Do Churches Pay In Canada. It is generally accepted that the church is an entity that does not pay taxes.

In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. This housing may take several forms including the payment of a housing allowance. And the only reason these.

Use the Clergy Housing In-Kind pay type if you pay for the housing and related expenses on your ministers behalf. Taxpayers view ministers as self-employed employees with the same tax deductions as traditional employees. Clergy Housing Tax Free - Canada 1044 views.

Depending on what sub-category they fall into they pay fringe benefits tax payroll tax land tax rates and other local government charges stamp duty and so on. Our team of Certified Compensation Professionals has analyzed survey data collected from thousands of HR departments at companies of all sizes and industries to. In some cases full-time church ministers and clergy members will not have to pay income taxes when providing services.

Do church workers pay tax. Since they have dual status as self-employed and as an employee of the church a churchs pastor would receive a W-2 at the end. If a pastor earns an income then they will pay federal income taxes on it like everybody else.

Farmers paid an average of 1932 in 1996 on all the crops when the complete data was available. So in fact you do pay rent by having salary withheld. The pastor will be able to claim the Clergy Housing Deduction as outlined in item 5 below e.

Cant speak for Canada but US. 105 the United States Supreme Court has ruled that the First Amendment guaranty of religious freedom is not violated by subjecting ministers to the federal income tax. Neither the pastor or the church has any say in the matter thats just the way it is.

Second churches are not allowed to withhold SECA taxes for pastors. A pastor typically pays their own payroll taxes as if they were self-employed. The church is not obligated to withhold income tax.

Churches Cannot Withhold SECA Taxes For Pastors. Attached as Exhibit A d. Do Ministers Pay Income Tax In Canada.

This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. Use the Clergy Housing Cash pay type if you provide funds to your minister to pay for their housing and related expensesThis will increase your ministers net pay. I was even in favor of the church paying for professional advice.

Pastor provides hisher own accommodation the church offers just a gross salary and the pastor is responsible to determine the fair market rental value of their house or apartment and hence the amount that they will claim as Clergy Residence Deduction. Should churches pay payroll taxes for pastors. The only thing that is not taxed are tax-exempt nonprofit organizations including churches.

This wont increase your ministers net. Still ministers have tried to argue against this ruling for decades. All personal individual income is taxed in the United States.

If requested by Canada Revenue Agency CRA. An employee who is a member of the clergy a regular minister or a member of a religious order can claim the Clergy Residence Deduction if they are in one of the following situations. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax.

There are two clergy housing items to choose from. There is a requirement that your exemption apply to a qualifying property that is part of the state qualifying property tax map. Since 1943 Murdock v.

If a church withholds SECA taxes it can mess up the pastors records with the Social Security Administration. In NSW they qualify for land tax concessions. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax.

The median annual Pastor salary is 93154 as of October 30 2017 with a range usually between 76557-105579 however this can vary widely depending on a variety of factors. This is a symbolic step and one that we can all take. Farmer federal taxes such as personal income tax self-employment tax and estate and gift tax account for the majority of farmers tax payments.

How Much Tax Does A Pastor Pay. Pastors most certainly pay taxes on their income.

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

Pastor Wedding Gift Religious Gifts For Pastor Christmas Etsy New Zealand

A Local Pastor S Open Letter To The Town Of Aylmer And Those Looking In Michael Krahn

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

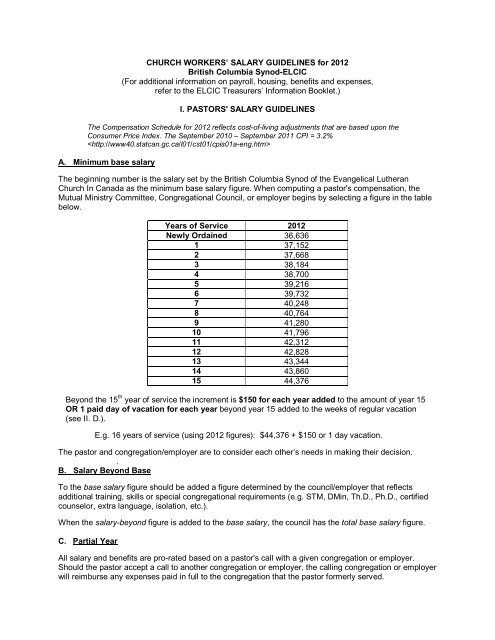

Church Workers Salary Guidelines For 2012 Bc Synod

Do Pastors Pay Taxes In Canada Ictsd Org

Gifts For Pastor Appreciation Gift Personalized Birthday Etsy

How Much Do Pastors Make In Alberta Cubetoronto Com

Pastor S Love Offering Gift Or Taxable Income The Pastor S Wallet

How Do I Become A Youth Pastor Ym360

Extra Income Archives The Pastor S Wallet

Adventist Pastor Salary Comparably

Pastors Parsonage Or Own Home Church Investors Fund

Do Pastors Pay Income Tax In Australia Ictsd Org

How Much Do Pastors Make In Alberta Cubetoronto Com

Everything Ministers Clergy Should Know About Their Housing Allowance

What You Need To Know About Earning Extra Income As A Pastor The Pastor S Wallet